Living in Portugal

- Home

- Start a business

- Living in Portugal

Visa and permit

Entering Portugal

The type of visa to obtain depends on the purpose of travel:

- Work

- Healthcare

- Study and research

- Vocational training, internship or voluntary work

- Youth Mobility

- Family Regrouping

- Religious training

- Establishment of residence

- Living off own income

Where to apply

At the Portuguese Consular Office in the country of residence.

See the list of Consular Offices here.

Cost

- Temporary stay visa - 75 €

- Visa for residence permit - 90 €.

You don't need a long-stay visa if you are:

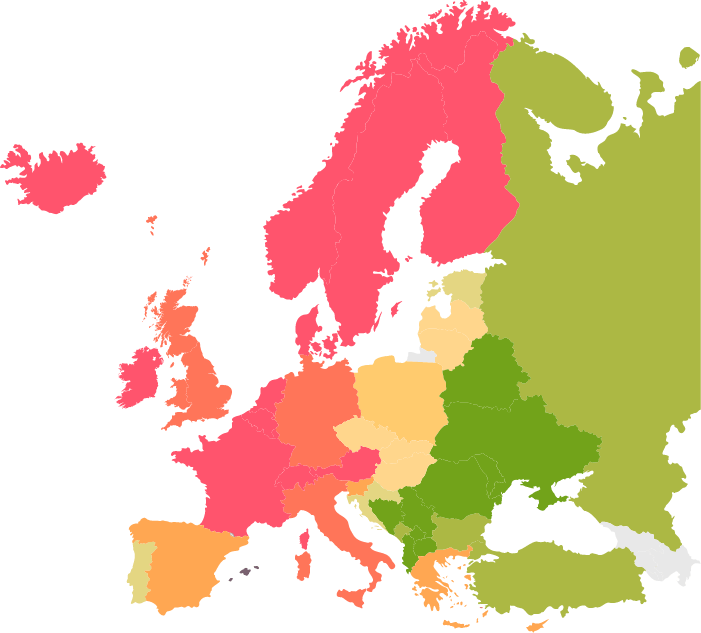

- National of a Member State of the European Union;

- National of a State belonging to the European Economic Area;

- National of a third State with which the European Union has an agreement on the free movement of persons;

- Family member of a Portuguese citizen or of a foreign citizen in one of the above situations.

More information here.

Living in Portugal

You should apply for an EU/EEA/Swiss Citizen Registration Certificate. which is a temporary residence permit.

Where to apply

After five consecutive years as a holder of a Registration Certificate, you can apply for a Certificate of Permanent Residence Registration

Where to apply

If you are a citizen of a Third State:

Portugal offers you special regimes for granting a temporary residence permit in a simple and fast way.

Benefit

- Residence visa exemption for entry in Portugal

- Live and work in Portugal

- Visa waiver for travel within the Schengen area

- Family reunification

- Access to the Portuguese national health system

- Obtaining the status of Non-Usual Resident for tax purposes

- Apply for permanent residence after 5 years of legal residence

- Applying for Portuguese Nationality after 5 years of legal residence

Golden Visa

Eligible activities

Setting up a company in Portugal or increasing the capital of an existing one based in Portugal, with a minimum investment of 500,000 euros, combined with the creation of five or maintenance of ten jobs (5 of them permanent)

Creation and maintenance of 10 full-time jobs during the required period (8 in low-density territories)

Investment or donation in artistic production or reconstruction of the national cultural heritage, in an amount equal to or greater than 250,000 Euros (can be reduced by 20% if the investment is destined for low-density territories)

Making a contribution to a Qualified Investment Fund of at least 500,000 Euros

Contribution to scientific research or technology in an amount equal to or greater than 500, 000 Euros (may be reduced by 20% if the investment is destined for low-density territories)

Other conditions required

- The investment activity must be maintained for at least 5 years, as from the moment when the residence visa was granted;

- The residence permit is renewable for two periods of two years, and the applicant must remain in Portuguese territory for seven days (consecutive or interpolated) in the first year and 14 days (consecutive or interpolated) in the subsequent two-year periods.

Taxes

| Frequency | Value | |

| Receipt and analysis of the application | Once at the beginning and then at each renewal | 605.10 Euros |

| Issue of authorization | Once at the beginning of the process | 6 045.20 Euros per person |

| Renewal of authorization | Each renewal | 3 023.20 Euros per person |

More information here

Start-up Visa

Hosting programme for foreign entrepreneurs who wish to develop an entrepreneurship and/or innovation project in Portugal

Foreign entrepreneurs who want to start an innovative company have access to a residence visa that will give them the possibility to create from scratch or relocate an existing Start-up to Portugal.

It shall be proven

- who intend to develop activities for the production of innovative goods and services in an internationalisation perspective;

- that their projects and/or companies focus on technology and knowledge, with prospects for developing innovative products;

- that have the potential to create skilled employment;

- who have the capacity to set up a business;

- that have the potential to achieve, within 5 years of the incubation contract, a turnover greater than 325 000€/year and/or an asset value greater than 325 000€/year.

More information here

Income obtained in Portugal

Income obtained abroad

- Not have had resident status in any of the previous 5 years:

- Register as a tax resident in Portugal at the Tax Office.

Condition

Has stayed more than 183 days in Portugal, consecutive or interpolated, in any period of 12 months or, having stayed for less time, has housing there in such conditions that make presume current intention to maintain and occupy it as habitual residence.

- The non-habitual resident acquires the right to be taxed as such for a period of 10 consecutive years.

- The taxpayer must register as a non-habitual resident in the taxpayer register of the Tax and Customs Authority.

Cost of living in Lisbon

- 64% cheaper than in New York

- 24% cheaper than in Munich

- 41% cheaper than in Amsterdam

- 19% cheaper than in Brussels

- 37% cheaper than in Paris

- 55% cheaper than in London

#117

In 227 cities around the world

Cost of Living City Ranking 2023 – Mercer

#39

In Europe

Cost of Living City Ranking 2023 – Mercer

Source: Expatistan

Reference prices

Water

With Lisbon as a reference, the tariffs have differentiated values according to consumption levels:

- up to 5 m3/metre: 0.4316 €/ m3 (plus VAT at 6%)

- from 6 to 15 m3/month: 0.8072 €/ m3 (plus VAT at 6%)

- from 16 to 25 m3/month: 1.8998 €/ m3 (plus VAT at 6%)

- over 25 m3/month: 2.4179 €/ m3 (plus VAT at 6%)

Electricity

It is possible to choose a free market operator. Prices vary depending on the contracted power and the type of timetable. Example of EDP Comercial tariffs (the oldest operator in the market) – BTN (Normal Low Voltage), for a contracted power of 6.9 kVA. simple tariff, 0.1929€/ kW/h energy cost, plus the value relating to the price of power (0.3952€/ day), plus VAT at the rate of 23%.

Natural Gas

At the time of this update, the Galp Energia tariff is 0.0839€/kWh; for a consumption of 205 kW over a 30-day supply period, this is approximately 24.80€ per month, including the subsoil occupation tax and VAT at the rate of 23%.

Fuels

The prices are updated in line with the variations in the price of a barrel of oil, and may present differences in the market. Minimum and maximum reference price values:

- Petrol 95 (litre); from 1.629€ a 2.039€

- Petrol 98 (litre); from 1.698€ a 2.087€

- Diesel (litre); from 1.429€ a 1.749€

National Minimum Wage (monthly): 870€

Food and beverages at the supermarket

Minimum and maximum prices, on average, for some products Included in a standard shopping basket:

- Milk (1 liter): 0,80€ a 1.99€

- Bread (1 Kg): 1.58€ a 6.12€

- Eggs (6 units): 1.09€ to 3.049€

- Meat (pork. 1 Kg); 4.49€ to 22.95€

- Meat (beef, 1 Kg): 6.49€ to 34.99€

- Cod (1 kg): 8.87€ a 29.98€€

- Fish (Hake, 1 Kg): 7.65€ to 20.38€

- Oranges (1 Kg): 1.09€ to 2.89€

- Apples (1 Kg): 1.58€ a 3.99€

- Potatoes (1 Kg): €1.15€ a 2.49€

- Beer (1 liter): 1.18€ a 4.94€

- Bottle of wine (0,75lt): 1.47€ to 50.00€

- Coca-Cola (1 litre): 0.99€ to 2.18€

Leisure

- Cup of coffee: 0.75€ to 1.30€

- Cinema ticket: 6.90€ a 9.80€

- Theatre ticket: 10.00€ to 35.00€

- Big Mac (McMenu): 5.60€

- Meal at Snack Bar: 8.00€ to 12.00€

- Restaurant Meal (2nd class): 18.00€ to 30.00€

Teaching

#35

Best Higher Education in the world

QS Higher Education System Strength Rankings 2018

The quality of the Portuguese education system is in the average of the OECD countries in the areas of science, reading and mathematics.

OECD (2023), PISA – Programme for International Student Assessment – Results of 2022

International schools

Eight universities in the ranking:

- University of Lisbon

- University of Porto

- University of Coimbra

- University of Aveiro

- Universidade Nova de Lisboa

- University of Minho

- ISCTE-IUL

- Universidade Católica Portuguesa - UCP

QS World University Rankings 2025

- Bachelor's Degree - Three to four years

- Master's Degree - One to two years

- PhD - Five years

Health care

#12 /190 countries

- #6 /UE 28

Better healthcare system

World Health Report 2019

Healthcare services are integrated in the SNS – Serviço Nacional de Saúde (National Health Service), supervised by the Ministry of Health, comprising health centres and public hospitals.

- EU citizens are SNS beneficiaries.

Registration in the SNS

- Valid identity document

- Social security card

- Proof of residence

- For each consultation or health care in the SNS. the beneficiary pays a usage fee (there are situations of exemption).

- In addition to health centres and public hospitals, there are several private health establishments and health professionals practicing in a liberal regime, who complete the offer of health care in a private regime or through agreements or conventions with the SNS.

- When you travel to Portugal, bring your European Health Insurance Card, which facilitates access to health care until identification as an SNS user is obtained.