Offer Qualification Support Line 2024

Recipients

SMEs and non-SMEs, as defined in Commission Delegated Directive (EU) 2023/2775 of 17 October 2023.

Types of operation

- Remodeling and repositioning of enterprises, establishments and activities (including expansion), relating to the economic activities defined;

- Creation of enterprises, establishments and activities related to the defined economic activities, provided that they are implemented in low-density territories (geographical delimitation in accordance with Council of Ministers Resolution no. 72/2016 of 20 October), are suitable for current or potential tourism demand, fill supply gaps and add value to the region;

- Entrepreneurship projects concerning the defined economic activities (*);

- Projects of any kind included in the REVIVE Program.

(*) Projects with up to 500,000 euros of eligible investment, aimed at creating innovative solutions (namely technology-based), and promoted by small or medium-sized companies that are to be created or that are less than five years old.

Main eligibility criteria

Companies

- Comply with the legal conditions necessary to carry out the respective activity, namely being duly licensed for the purpose and duly registered in the National Tourism Registry, when legally required;

- Be a member of the Empresas Turismo 360° Program, signing the respective letter of commitment available at https://empresasturismo360.turismodeportugal.pt/EmpTur360/compromissos.aspx

- Be in good standing in relation to the Tax Administration, Social Security Office and Turismo de Portugal;

- Must not have unpaid wages, except in situations pending in court;

- Have staff suitable for carrying out the respective activity.

Projects

- In the case of an urban operation subject to a licence, the architectural project must be duly approved by City Council;

- The sources of funding have been secured, including a minimum of 20% equity of the eligible investment;

- Contribute to the economic and financial improvement of their respective companies;

- Not exceed 2 years of execution, except in justified and accepted situations;

- Include the implementation of (i) environmentally responsible measures (energy, water and waste) and (ii) socially responsible measures (valuing people and communities and accessibility).

Evaluation of the project's environmental and social responsibility measures

Before submitting the application to the credit institution, the company must check the overall score of the project regarding the environmental and social responsibility measures to be implemented, which cannot be less than a total of 45 points in the two types of measures (in each of these measures, the score obtained cannot be less than 15 points).

To check the score, the company must access the online services available on the Business Portal of Turismo de Portugal, I.P. and fill out the relevant form, indicating, if the required score is obtained, which credit institutions will have access to this information.

Funding

Maximum amount per project

The amount of funding cannot exceed 80% of the eligible investment.

Turismo de Portugal’s participation is limited to 3 million euros.

Structure

General conditions

SME

- 40% – Turismo Portugal

- 60% – Credit Institution

Non-SME

- 30% – Turismo Portugal

- 70% – Credit Institution

Projects Regarding Entrepreneurship / Implemented in Low-Density Territories / Located in the Algarve Region / Integrated into the REVIVE Program

Specific conditions ( exclusive for SMEs)

- 75% – Turismo Portugal

- 25% – Instituição de Crédito

Repayment

SME

15-year repayment period, including a 4-year grace period

Non-SME

10-year repayment period, including a 3-year grace period

Interest rates

Tranche Turismo Portugal

No interest

Tranche Credit Institutions

The one resulting from the risk analysis carried out by the Credit Institutions

Access to performance bonus

Part of the funding component allocated by TURISMO DE PORTUGAL may be converted into NON-REFUNDABLE SUPPORT if the following targets are achieved (contained in the business plan submitted to the Bank, to be measured during the third full year of operation):

a) Turnover (TO) and Gross Value Added (GVA);

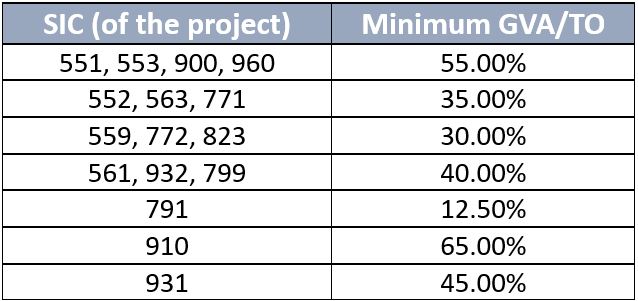

b) GVA/TO ratio higher than that recorded in the pre-project year, if applicable, with the following minimum values per SIC:

c) Jobs created.

Bonus Amount: SME 25% / Non-SME 5%

Additional to the performance bonus

10 p.p.: for companies recognised with the Sustainability Leader label (Tourism 360° Program), provided it was awarded during the 2nd full year of operation.

It is up to the companies to ensure that the performance data is monitored using FOREST – Organisational Tool for Sustainability Reporting in Tourism, available by joining the Tourism 360° Program.

Applications

Submitted to one of the following Credit Institutions, after obtaining a favorable assessment of the environmental and social responsibility measures:

- Abanca

- Bankinter

- BPI

- Crédito Agrícola

- Torres Vedras Caixa de Crédito Agrícola Mútuo

- Caixa Económica Montepio Geral

- Caixa Geral de Depósitos

- EuroBic

- Millennium BCP

- Novo Banco

- Novo Banco dos Açores

- Santander